Introduction

Kolkata, often celebrated as the cultural capital of India, is now making waves for a different reason—its booming real estate sector. With a fine blend of heritage charm and modern infrastructure, Kolkata real estate is attracting attention from both end-users and savvy investors. Over the past few years, the city has seen a strategic transformation fueled by rapid urbanisation, growing employment hubs, upgraded connectivity, and government-driven development initiatives.

What makes Kolkata stand out as an investment hotspot is its affordability when compared to Tier-1 cities like Mumbai, Delhi, or Bangalore. Despite being a major metro, Kolkata still offers competitive property prices, making it more accessible for first-time buyers. At the same time, the city is witnessing a consistent appreciation in property values, especially in emerging zones like New Town, Rajarhat, and Joka—thanks to metro rail expansion, flyover construction, and the rise of IT corridors.

Whether you’re planning to buy your dream home in a peaceful residential area or invest in commercial property with high rental potential, Kolkata provides diverse real estate options tailored to every budget and investment goal. From affordable housing in the suburbs to luxury apartments near EM Bypass and Salt Lake, the market is full of opportunities waiting to be explored.

This guide is your comprehensive companion to understanding property investment in Kolkata. We will take a deep dive into why Kolkata is the right choice for real estate, identify the best locations to buy property, analyze the latest market trends, explain legal and financial aspects, and share proven tips to make your investment journey smooth and profitable.

Whether you’re a first-time homebuyer, a seasoned investor, or someone exploring high-yield rental income opportunities, this guide is designed to provide clarity, reduce risk, and help you navigate Kolkata’s dynamic property market with confidence.

Key Takeaways

- Best Investment Locations: Focus on high-growth areas such as New Town, Rajarhat, EM Bypass, Salt Lake, and Joka, which offer excellent connectivity and promising appreciation.

- Growth Potential: Infrastructure upgrades and the expansion of IT hubs are fueling steady appreciation in Kolkata’s property values.

- Legal Considerations: Always ensure that your shortlisted project is RERA-compliant, verify the title deed, and understand applicable taxes and duties before signing any agreement.

- Investment Types: Evaluate your goals—whether you’re looking for long-term rental income or asset appreciation—to choose between residential and commercial properties.

- Government Policies: Take advantage of central schemes such as PMAY (Pradhan Mantri Awas Yojana) and tax deductions under Sections 80C and 24(b) for homebuyers.

- Market Trends: Kolkata is witnessing a consistent rise in rental demand, especially in IT corridors and student-friendly neighborhoods, along with 5-8% property appreciation annually in key zones.

- Risk Factors: Pay attention to the builder’s track record, project delivery timelines, local civic infrastructure, and future development plans before investing.

- Best Practices: Conduct in-depth market research, compare properties based on ROI and future demand, and factor in your loan eligibility and long-term financial planning.

Why Invest in Kolkata Real Estate?

Kolkata is emerging as one of India’s most promising real estate destinations, thanks to its strategic growth trajectory, affordable pricing, and expanding infrastructure. Whether you’re a first-time buyer or a seasoned investor, there are compelling reasons why investing in Kolkata real estate in 2024 is a smart and forward-looking decision.

Let’s break down the key factors that make property investment in Kolkata both attractive and rewarding:

1. Affordable Prices & High Appreciation Potential

One of the strongest advantages Kolkata holds over other metropolitan cities is its affordable property pricing. Compared to Mumbai, Delhi NCR, Bangalore, or Hyderabad, Kolkata offers relatively low entry points for investors while ensuring promising returns in the long run.

- The average price per square foot in prime residential areas like Salt Lake or New Town remains significantly lower than equivalent zones in other Tier-1 cities.

- This affordability opens up opportunities for first-time homebuyers and investors looking to diversify their portfolios.

- What makes this affordability even more attractive is the city’s high appreciation potential—property values in growth corridors have been rising steadily, driven by infrastructure projects and urban development.

- Micro-markets such as Joka, Rajarhat, and Behala are rapidly gaining popularity due to proposed metro extensions, highway upgrades, and new township developments.

- Real estate in Kolkata is also less volatile, making it an ideal choice for long-term investment with stable returns.

Whether you’re planning to buy a flat for self-use or seeking a high-growth resale opportunity, Kolkata real estate market trends strongly favor appreciation over time.

2. Infrastructure Growth & Connectivity

Infrastructure is a major growth catalyst, and Kolkata is currently undergoing significant upgrades across transportation, housing, and urban planning.

- The ongoing Kolkata Metro expansions, including the East-West corridor and the Joka to BBD Bagh line, are transforming how residents commute while boosting property values near metro stations.

- Several new flyovers and arterial roads are improving cross-city connectivity, reducing traffic bottlenecks, and making suburban areas more accessible.

- IT hubs and business parks in New Town and Salt Lake Sector V are drawing professionals from across India, creating a strong demand for quality housing and rental accommodations nearby.

- The government’s focus on Smart City development, sustainable living, green zones, and improved public services has added a new dimension to the city’s liveability index.

- Infrastructure enhancements are not limited to transport—they also include better civic amenities like drainage, street lighting, parks, and waste management systems.

All of this means that areas currently considered “upcoming” could become tomorrow’s most sought-after investment zones—perfect for those looking to buy property in Kolkata ahead of the curve.

3. Booming Rental Market

The demand for rental housing in Kolkata has seen consistent growth, making it a lucrative option for investors seeking passive income through rentals.

- The city is a hub for IT professionals, college students, educators, doctors, and other working professionals, particularly in and around New Town, Rajarhat, Salt Lake, and EM Bypass.

- Rental yields in these areas are increasing at a steady pace, with 5% to 8% annual appreciation—a healthy return compared to many other urban rental markets.

- For commercial investors, the rise of co-working spaces, office hubs, and small business parks means commercial rentals are also booming, especially in IT and SEZ zones.

- Furnished apartments and service flats are in high demand among students, corporate employees, and medical tourists—presenting additional income opportunities for landlords.

- Properties near metro stations, educational institutions, and business clusters have especially strong rental appeal.

If you’re considering an investment property, Kolkata’s high-demand rental pockets make it easier to find reliable tenants and maintain occupancy throughout the year.

Best Areas for Real Estate Investment in Kolkata

| Location | Property Type | Avg Price/Sq. Ft | Investment Potential |

| New Town | Apartments, Villas | ₹5,500 – ₹7,500 | High – IT Hub, Metro Expansion |

| Rajarhat | Flats, Commercial | ₹4,500 – ₹6,500 | Growing – Affordable, Upcoming Projects |

| EM Bypass | Premium Flats | ₹9,000 – ₹12,000 | Connectivity, Luxury Homes |

| Salt Lake | Apartments | ₹7,000 – ₹9,500 | Stable – Established Residential Zone |

| Joka | Budget Homes | ₹3,500 – ₹5,000 | Emerging – Metro Expansion, Affordable |

| Behala | Mid-range Flats | ₹4,000 – ₹6,500 | Rising – Infrastructure Improvement |

| Howrah | Budget to Luxury | ₹3,500 – ₹8,000 | Expanding – New Commercial Projects |

Residential vs. Commercial Real Estate: Which One Should You Choose?

| Factor | Residential Property | Commercial Property |

| Investment Cost | Lower, ideal for first-time buyers | Higher, but better ROI |

| Rental Income | Stable, moderate returns | High returns, tenant dependency |

| Growth Potential | Appreciates steadily over time | High appreciation in prime locations |

| Maintenance Costs | Lower & manageable | Higher due to infrastructure needs |

| Market Liquidity | Easier resale & demand | Longer holding period needed |

Kolkata Real Estate Market Trends & Future Growth

The Kolkata real estate market is experiencing a dynamic evolution driven by urban infrastructure upgrades, government-led initiatives, and increasing investor interest—both domestic and foreign. Whether you’re a first-time buyer or an experienced investor, staying updated with current trends and forecasting future opportunities is key to making sound real estate decisions.

Here’s a deeper look at the market shifts shaping the future of property investment in Kolkata:

1. Steady Annual Property Appreciation

One of the most encouraging signs for investors is the city’s consistent property appreciation rate. Key residential and commercial zones in Kolkata are witnessing annual capital value growth of 5% to 8%, which is highly competitive compared to many Indian metros.

- Areas like New Town, EM Bypass, Salt Lake, and Rajarhat have recorded steady upward trends in property prices over the past few years.

- With infrastructure like metro lines and IT parks nearing completion, appreciation is expected to accelerate further.

- For long-term investors, Kolkata offers sustainable growth with relatively low volatility, making it an excellent choice for both capital appreciation and rental yields.

2. Strong Rental Demand in Strategic Zones

Rental demand in Kolkata continues to surge, particularly in areas that are close to IT corridors, business parks, universities, and healthcare institutions.

- Regions like Salt Lake Sector V, New Town Action Areas I & II, and EM Bypass have emerged as rental hotspots due to their proximity to commercial hubs and ease of commute.

- The city’s growing student population, working professionals, and medical tourists have pushed demand for both long-term and short-term rentals.

- Property owners in these zones are enjoying increasing rental income, making rental investment in Kolkata a highly viable strategy.

3. Pipeline of Luxury Townships & Mega Projects

The coming years will see a host of high-value residential and mixed-use developments across the city, especially in growth corridors.

- Top real estate developers are launching premium gated communities, integrated smart townships, and high-rise luxury apartments in key areas.

- The development of SEZs, IT parks, and large commercial complexes will further attract buyers and tenants, fuelling both demand and prices.

- These mega projects are not only modern in design but also equipped with world-class amenities such as rooftop gardens, co-working zones, wellness centers, and EV charging stations.

4. Rising FDI Inflows & Institutional Investments

The Kolkata property market is also beginning to draw significant interest from foreign investors and institutional funds, marking its potential on the national investment radar.

- Increased FDI (Foreign Direct Investment) is flowing into both residential and commercial real estate segments, accelerating development timelines and improving construction quality.

- International partnerships are encouraging innovation and sustainable design in upcoming projects.

- This institutional backing gives buyers more confidence in project delivery and returns, especially for large-scale developments in and around Rajarhat and New Town.

5. Smart City & Sustainable Development Initiatives

Kolkata is part of the Government of India’s Smart Cities Mission, which is driving large-scale upgrades in infrastructure, digitization, energy management, and public services.

- These developments are elevating the city’s liveability quotient and enhancing the long-term value of properties.

- The adoption of green building practices and sustainable construction techniques is becoming mainstream, with a growing number of new projects offering energy-efficient homes, rainwater harvesting, solar panels, and eco-friendly designs.

For environmentally conscious buyers and investors, Kolkata’s growing shift towards green architecture is a value-add that enhances both market appeal and future appreciation.

Legal & Financial Aspects to Consider Before Investing

| Aspect | Details |

| RERA Compliance | Check if the project is registered under RERA. |

| Property Title | Verify legal ownership & encumbrances. |

| Loan Eligibility | Understand home loan options & EMI structures. |

| Stamp Duty & Taxes | Account for 5%-7% stamp duty in Kolkata. |

| Builder Reputation | Research builder history & past project delivery. |

| Home Loan Interest | Compare rates from banks & financial institutions. |

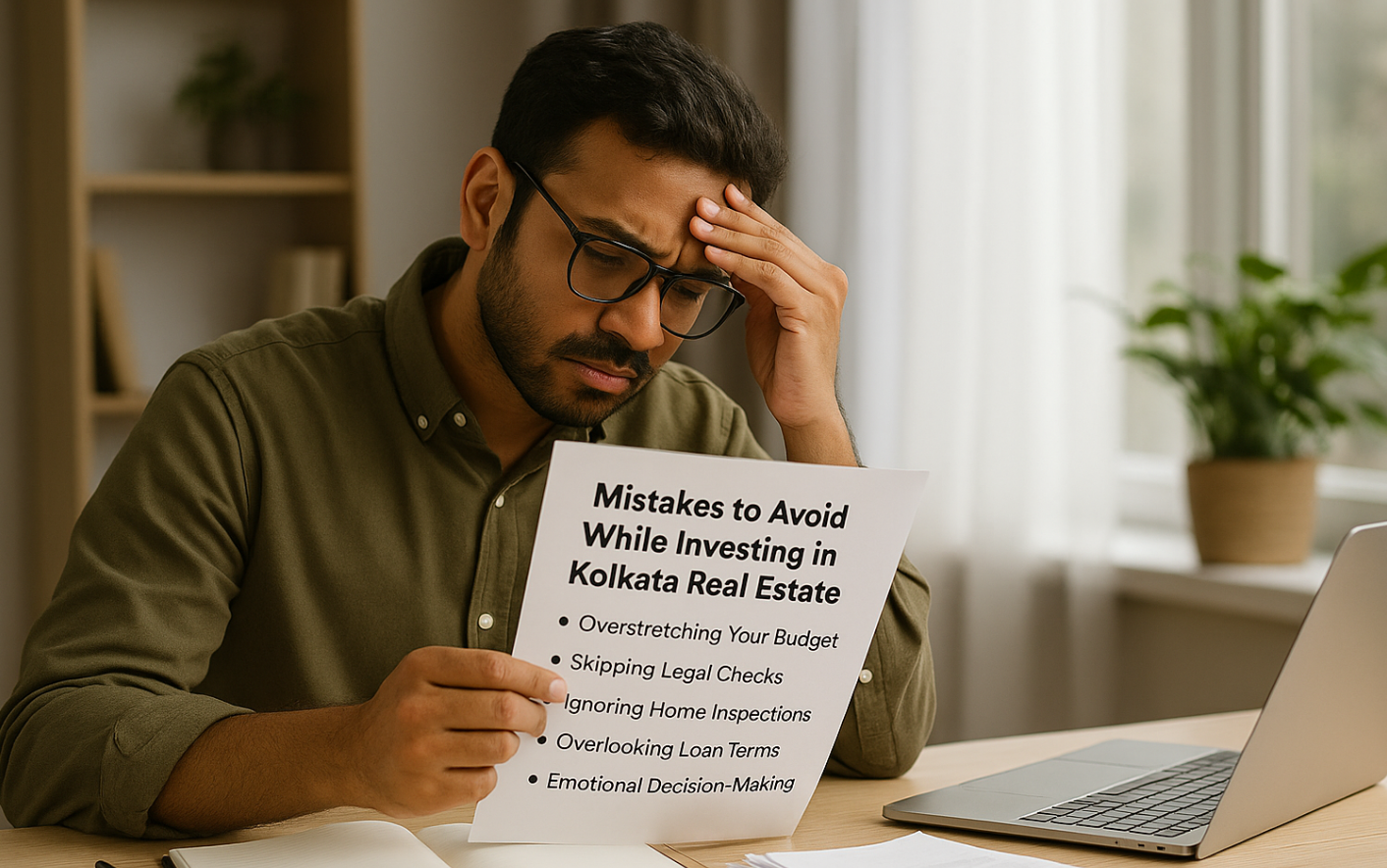

Mistakes to Avoid While Investing in Kolkata Real Estate

While investing in Kolkata real estate offers excellent long-term potential, it’s essential to proceed with informed decision-making. Even experienced buyers can fall prey to seemingly minor oversights that can later result in financial strain, legal complications, or poor returns.

Here are some of the most common mistakes first-time buyers and investors make—and how to avoid them for a smooth and rewarding property investment experience:

1. Not Researching RERA Registration Before Buying

One of the most important steps in any property purchase is verifying whether the project is registered with RERA (Real Estate Regulatory Authority).

- Many buyers overlook this, assuming the builder’s reputation is enough.

- RERA compliance ensures the project has been approved by authorities and offers protection against fraud, delays, or misrepresentation.

- Always check the project’s RERA number and cross-verify it on the official portal before signing any agreement.

In Kolkata, with many upcoming and under-construction developments, this step is non-negotiable for securing your investment.

2. Overlooking Maintenance & Hidden Costs

It’s easy to get fixated on the base price of a property and forget the additional costs that accompany homeownership.

- These may include society maintenance charges, GST on under-construction properties, parking fees, club membership charges, brokerage, and more.

- For luxury and gated communities, monthly or annual maintenance can be substantial and should be budgeted accordingly.

Ignoring these costs can lead to unpleasant surprises after possession and may affect your loan EMI planning as well.

3. Choosing the Wrong Property Type Based on Goals

Each type of property—whether residential, commercial, or mixed-use—has its own benefits and risks. The key is to align your choice with your investment objective.

- Buying a residential apartment for rental income is very different from buying commercial office space for resale or leasing.

- A mismatch between your financial goals and the property type could lead to unsatisfactory returns or poor asset utilization.

- For instance, investing in a luxury home might not be wise if your goal is quick liquidity or high rental yield.

Always start by asking: Is this property aligned with my short- and long-term goals?

4. Ignoring Location Appreciation Trends

The location of the property is one of the biggest determinants of its long-term value. Yet, many buyers choose locations based solely on current pricing without evaluating future growth potential.

- Areas with low property prices might seem attractive now but could stagnate in value due to a lack of infrastructure or demand.

- On the other hand, locations like Rajarhat, New Town, and Joka are rapidly growing thanks to metro expansions, IT hubs, and township developments—making them great for appreciation and rental demand.

- Use past trends, upcoming projects, and city development plans to assess a location’s future worth.

5. Investing in Areas with Low Rental Demand

If your goal is passive rental income, location matters even more.

- Avoid investing in neighborhoods that are too far from commercial or educational centers unless you’re sure there’s consistent tenant demand.

- Conduct rental yield analysis in the area and consult property advisors to identify high-demand zones like Salt Lake, Sector V, and EM Bypass.

A property without tenants is a dead investment—it generates no return and continues to incur costs.

6. Underestimating Loan EMI Affordability

Home loans are a long-term financial commitment, and many first-time buyers stretch their budget to buy a larger or more luxurious property than they can afford comfortably.

- This often leads to financial stress, missed EMIs, or overdependence on credit, which impacts overall financial health.

- Before finalizing a property, use a reliable EMI calculator to assess monthly obligations and maintain a buffer for emergencies and hidden charges.

- Experts recommend ensuring that your EMI does not exceed 35%-40% of your monthly income.

Proper financial planning will help you manage your investment efficiently while enjoying peace of mind.

Conclusion

Kolkata stands at the crossroads of tradition and transformation, offering one of the most balanced real estate ecosystems in India today. With its competitive property pricing, expanding infrastructure, and strong rental demand, the Kolkata real estate market is an ideal ground for both first-time buyers and seasoned investors.

Whether you’re aiming for capital appreciation in emerging localities like Rajarhat and Joka or stable rental income from established zones like Salt Lake and New Town, property investment in Kolkata delivers diverse opportunities that cater to every budget and goal.

But as with any investment, success depends on strategy. When you invest with clarity—by choosing the right location, verifying legal aspects, and understanding your financial limits—you significantly reduce risk and increase long-term gains.

At Get My Ghar, we simplify that journey. From discovering verified listings to securing the right property deals with expert advice, we help you invest smarter, not harder.

Pro Tip from the Experts

Don’t just follow the crowd—follow the data.

Before you invest in any property, study the local demand trends, upcoming infrastructure, past price appreciation, and RERA registration. Use these data points to forecast value—not hype. This approach helps you identify high-potential properties early, especially in a market as dynamic as Kolkata.

Frequently Asked Questions (FAQs)

Q1. Is investing in Kolkata real estate a good decision in 2024?

Yes, 2024 is considered one of the best times to invest in Kolkata real estate. The city offers a perfect blend of affordable property prices, large-scale infrastructure developments, and rising demand for both residential and commercial spaces. The ongoing metro rail expansions, development of IT and business parks in New Town and Rajarhat, and the emergence of new townships are all contributing to long-term appreciation and higher rental yields. Compared to other metro cities, Kolkata still provides low entry barriers, making it especially attractive for first-time homebuyers and investors.

Q2. Which is the best area to buy property in Kolkata?

Some of the top-performing and high-potential real estate zones in Kolkata include:

- New Town is known for its IT and corporate hubs, metro connectivity, and modern infrastructure.

- Rajarhat – An upcoming locality offering affordability, fast-paced development, and good social amenities.

- Salt Lake City (Bidhannagar) – An established, premium locality popular among professionals and families.

- EM Bypass – Home to luxury residential projects and offering excellent connectivity to key city areas.

- Joka and Behala – These are emerging as value-for-money destinations due to metro expansion and township projects.

Your ideal location depends on your goals—whether you’re buying for self-use, rental income, or long-term appreciation.

Q3. How much down payment is required for buying property in Kolkata?

In most cases, banks and financial institutions provide 75% to 90% of the property’s value as a home loan. The remaining 10% to 25% must be paid up front as a down payment. This percentage can vary based on your credit score, bank policies, and whether you’re eligible for government schemes such as PMAY (Pradhan Mantri Awas Yojana).

For example, for a ₹50 lakh property in Kolkata, you would typically need to arrange ₹5 to ₹12.5 lakh as your initial contribution. Always budget extra for registration charges, stamp duty, GST (if applicable), and legal fees.

Q4. What are the tax benefits for homebuyers in India?

Homebuyers in India can claim several income tax deductions that significantly reduce the effective cost of owning a home:

- Section 80C: Deduction of up to ₹1.5 lakh per year on repayment of the principal amount of the home loan.

- Section 24(b): Deduction of up to ₹2 lakh per year on interest paid on the home loan, applicable for self-occupied properties.

- PMAY-CLSS Scheme: Eligible first-time buyers under Pradhan Mantri Awas Yojana (PMAY) may receive an interest subsidy based on their income group.

These benefits not only promote homeownership but also enhance overall affordability for buyers.

Q5. What is the role of RERA in Kolkata real estate?

RERA (Real Estate Regulatory Authority) was implemented to protect buyers’ interests and bring transparency, accountability, and reliability to the real estate sector. In Kolkata and across West Bengal, it’s mandatory for all new residential and commercial projects to be registered under RERA.

Before investing, buyers should verify the project’s RERA registration number, which ensures:

- The builder has all the necessary approvals and clearances.

- Project timelines and financial details are transparently disclosed.

- Buyers can seek legal remedy in case of delays or discrepancies.

Q6. Are there good options for affordable housing in Kolkata?

Yes, Kolkata is one of the few metro cities where affordable housing options are still widely available. Areas like Joka, Behala, Narendrapur, and Madhyamgram offer 1BHK and 2BHK flats starting from ₹25–₹35 lakh, many of which are part of modern gated communities with essential amenities.

Moreover, under schemes like PMAY, eligible homebuyers can avail subsidies, further reducing the cost of homeownership.

Q7. Can NRIs invest in real estate in Kolkata?

Yes, Non-Resident Indians (NRIs) are allowed to buy both residential and commercial properties in Kolkata and other Indian cities. However, agricultural land, farmhouses, and plantation properties are restricted for NRIs.

NRIs can fund their purchases through:

- NRE/NRO accounts

- Home loans from Indian banks

- Power of Attorney (PoA) for managing transactions remotely

NRIs often invest in high-end apartments in Salt Lake, New Town, or Ballygunge due to the capital appreciation potential and rental returns.

Q8. How do I know if a locality has high investment potential?

To assess a location’s potential, consider:

- Connectivity: Proximity to metro stations, arterial roads, and public transport.

- Employment hubs: Distance from IT parks, SEZs, or corporate districts.

- Infrastructure projects: Ongoing or upcoming flyovers, townships, and civic upgrades.

- Rental demand: Presence of working professionals, students, or commercial hubs.

- Past appreciation trends: Historical data can reveal growth patterns.

Locations like Rajarhat and EM Bypass show strong signs of future growth due to ongoing development.