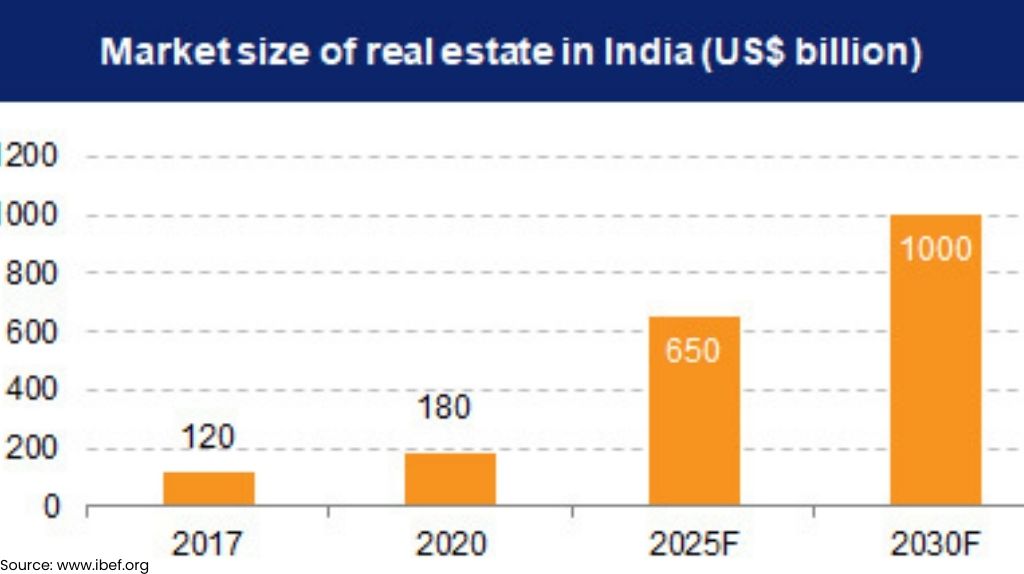

Indian Real Estate Market Trends in 2024

The Indian real estate industry has long been a thriving and fast-paced one. The government’s efforts to build infrastructure, provide cheap housing, and implement urban planning policies are causing a significant shift in the real estate market. The main themes that will influence India’s real estate industry in 2024 will be covered in this blog. You will discover how real estate contributes to India’s GDP, how big the market is predicted to become by 2030, what influences trends, how government initiatives affect real estate trends, and a lot more. This site is your go-to source for everything about Indian Real Estate Trends in 2024, whether you’re looking to invest or you just want to learn more about the country’s real estate market.

Understanding India's Real Estate Market

The real estate industry in India is a vital component of the country’s economy, including a range of industries including residential, commercial, retail, and hospitality. Real estate developers, financial institutions, and homebuyers are among the important stakeholders in this sector, which is influenced by variables like interest rates, market growth, and supply-demand dynamics. Notably, the commercial real estate market is still expanding quickly, which emphasizes how dynamic the industry is.

Real Estate's Contribution to India's GDP

The real estate sector, which includes residential, commercial, retail, and hospitality assets, makes a significant GDP contribution to India. The creation of jobs, the disbursement of home loans, and construction activities all have an impact on GDP, indicating potential for growth and investment. The performance of the industry has a big impact on the nation’s economy as a whole.

Important Elements Affecting India's Real Estate Trends

Real estate trends in India are heavily shaped by supply and demand dynamics, while market size, competitive advantage, and sustainability all have an impact on investment potential. It is impossible to overstate the importance of transportation networks, infrastructure development, and governmental assistance. The Indian real estate market is evolving due in large part to factors including affordability, security measures, and rising demand.

Dynamics of Supply and Demand

Indian real estate trends, which are influenced by changing consumer preferences and sustainability concerns, show the dynamics of supply and demand in the residential, commercial, and retail markets. In addition to being impacted by elements like affordability, growing demand, and a feeling of community, the market is also impacted by the distribution of housing loans, the expansion of the office sector, and the luxury house market. Artificial intelligence, data centres, and institutional investments will propel future growth. Get My Ghar, one of India’s realtors with the quickest rate of growth, provides a wide range of solutions to satisfy the supply and demands of different societal groups.

Opportunities and Difficulties for Investing

The retail, business, and residential sectors of the Indian economy all present a variety of investment opportunities. But it’s important to take into account issues like renter preferences, market share, and affordability. A few of the things that investors consider are ROI, tax advantages, and institutional investments. There are opportunities and difficulties associated with the emerging trends in cheap housing, luxury residences, and the office sector. The growth potential of the industry draws foreign direct investment (FDI), private consumption, and institutional capital.

Opportunities bring with them the task of choosing the best investing plan. Thousands of investors have benefited from Get My Ghar’s extensive experience and database of properties in India in helping them make the best decision.

Policy Assistance and Its Consequences

The direction of real estate trends is significantly influenced by laws and regulations from the government. The dynamics of the business are significantly impacted by policy interventions that support tax breaks, infrastructure development, and affordable housing programs. The real estate market is also impacted by growth-oriented policies, affordability, and sustainability. These legislative actions have a direct impact on institutional investments and market share, giving industry participants a competitive edge.

Governmental Initiatives' Effect on Real Estate Trends

Government programs, such as those pertaining to affordable housing, have completely changed the real estate landscape and the dynamics of the Indian market. In addition, the size of the real estate market and its landscape are greatly influenced by laws related to urban planning and infrastructure development. The real estate industry gains from policy support, especially in the areas of affordable housing, office space, and luxury houses. These programs expand the market, provide doors for investment, and affect the dynamics of supply and demand, which has a big impact on amenities, affordability, and market share.

Plans for Inexpensive Housing

The housing needs of middle-class and lower-class individuals are met by government programs in affordable housing, which provide financial incentives, tax breaks, and subsidies. These programs seek to encourage urban housing development, homeownership, and the supply of cheap housing. The real estate environment, market size, and supply-demand dynamics are all impacted by policy initiatives, which also create chances for housing loans and support the sector’s expansion.

Policies for Urban Planning & Infrastructure Development

The goal of infrastructure development policies is to establish sustainable urban ecosystems, which has an impact on the real estate market. Urban planning strategies have an impact on the dynamics of supply and demand in cities by addressing issues related to housing, transportation, and commercial real estate. Through infrastructure and urban planning policies, government activities encourage investments, market expansion, and demand for commercial assets. These regulations have a significant impact on market share in the real estate industry as well as transportation networks.

Indian Real Estate's Future

While environmentally friendly and sustainably built homes continue to change the real estate scene in India, smart home technology is pushing the country toward more sophisticated security systems. An increase in institutional investments is projected by 2024, highlighting the significance of amenities and transportation networks. Artificial intelligence is also expected to transform the sector and open the door for innovative advancements. The CTO of Get My Ghar, working with the technology team, has integrated a number of artificial intelligence capabilities into daily transactions, keeping in mind the demands of prospective homeowners.

In 2024, how should prospective investors negotiate the Indian real estate market?

It is imperative for prospective investors to take into account the competitive advantage of commercial properties across different market categories. Gaining an understanding of the local community in particular real estate locales might yield insightful information. Prospective homeowners must evaluate how interest rates, tax advantages, and affordability affect the demand for housing loans. Tenants are better able to make decisions when they investigate the facilities and security systems available in rental residences. Determining a real estate development’s carbon footprint helps investors make sustainable investing choices.

In conclusion, considerable expansion and change are anticipated in the Indian real estate sector in the upcoming years. The sector is changing and creating new opportunities as a result of factors like rising demand, government efforts, and foreign investments. Innovation is being spurred and an environment that is conducive to investment is being created by the emphasis on affordable housing, infrastructure development, and sustainable cities. It can be difficult to navigate the Indian real estate market, though. Before making any investment selections, prospective investors should make sure they are well-informed, consult with experts, and carry out a complete investigation. Investors can take advantage of the Indian real estate sector’s growth potential by being educated about current trends and comprehending market dynamics.