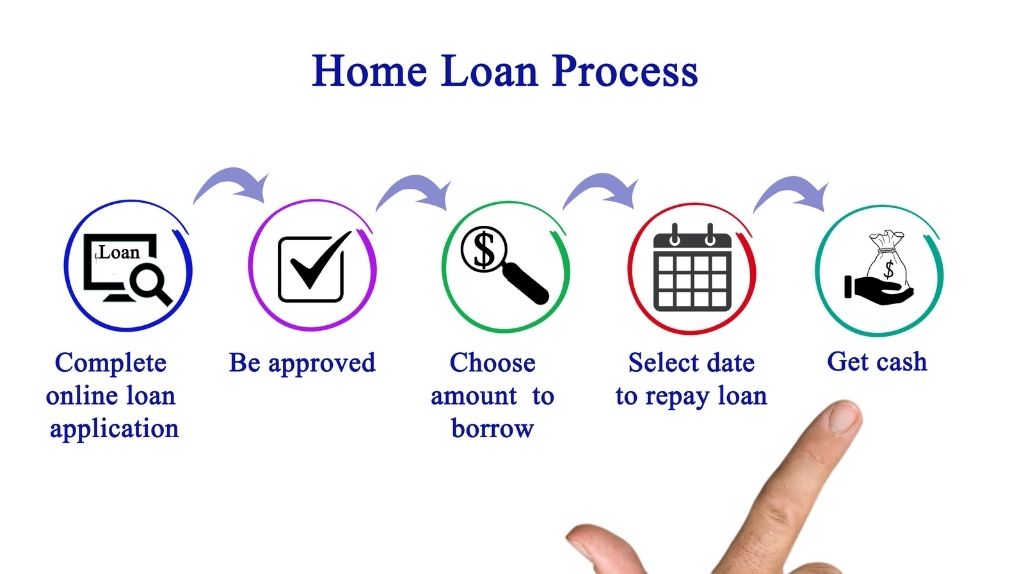

Banks play a vital role in shaping the financial stability of both individuals and families. Home loans are among the most important services provided by banks. One kind of bond that helps people realize their ambition of owning a home is a home loan. On the other hand, interest rates for house loans might vary dramatically across banks. This interest rate differential may have a significant impact on the borrower’s financial burden. Finding banks that provide the best interest rates on house loans is crucial. We’ll talk about a few of the banks offering the cheapest interest rates on house loans in this blog article.

1. State Bank of India (SBI)

Home loan interest rates from SBI, the biggest public sector bank in India, are among the lowest. Home loans are available from SBI with interest rates as low as 6.95% for female borrowers and 7% for other borrowers. Furthermore, SBI provides borrowers who apply for a house loan using their online platform with an interest rate reduction of 0.05%. In addition, SBI provides several additional advantages, including no prepayment fees, minimal administrative costs, and the flexibility to convert to a lower interest rate down the road.

2. HDFC Bank

One of India’s biggest private sector banks, HDFC Bank, is well-known for offering house loans at affordable interest rates. For female borrowers, HDFC provides house loans with interest rates as low as 6.95%, whereas for other borrowers, the rate is 7.05%. Additionally, borrowers who apply online might get a 0.05% interest rate discount from the bank. Aside from these alluring features, HDFC also provides a top-up loan facility, no prepayment penalties, and flexible repayment alternatives.

3. ICICI Bank:

ICICI Bank, a leading private sector bank in India, has been instrumental in revolutionizing the home loan segment with its attractive interest rates. The bank provides transparent and convenient home loan solutions, assisting borrowers in making their homeownership dreams come true without excessive financial strain. ICICI Bank also offers numerous additional features, such as flexible repayment options, balance transfer facilities, and special interest rates for women borrowers.

4. Axis Bank:

Axis Bank takes pride in offering some of the most competitive interest rates on home loans in India. With a diverse range of home loan products tailored to suit individual preferences, Axis Bank ensures borrowers can easily choose the most favorable option for their financial situation. The bank provides simplified documentation processes, streamlined approval mechanisms, and even reduced interest rates for salaried applicants with a strong credit history.

5. Baroda Bank

A public sector bank, Bank of Baroda, is well-known for offering house loans at competitive interest rates. The bank provides house loans with interest rates that begin at 6.85% for borrowers who are women and 6.90% for borrowers who are not. Additionally, borrowers with a steady income and a strong credit score might get a 0.25% interest rate discount from the Bank of Baroda. In addition, the bank provides additional advantages such as no prepayment penalties, minimal processing costs, and the ability to later move the loan to a cheaper interest rate.

6. Canara Bank

Another public-sector bank that provides reasonable interest rates on house loans is Canara Bank. The bank provides house loans with interest rates that begin at 6.90% for borrowers who are women and 6.95% for borrowers who are not. Additionally, Canara Bank grants online applicants an interest rate reduction of 0.05%. The bank offers perks including flexible repayment choices, no prepayment penalties, and the ability to transfer to a lower interest rate in the future, in addition to cheap interest rates.

Exclusive loan offers and deals:

Get My Ghar offers invaluable assistance in securing your home loan. With a user-friendly platform and expert guidance, it simplifies the home loan application process, ensuring a smooth and efficient experience. Trust GMG to help you turn your dream home into a reality by providing personalized solutions tailored to your financial needs.

In conclusion, while there are several banks that offer home loans, it is essential to compare the interest rates and benefits offered by different banks before choosing one. The banks mentioned above are some of the top players in the market with the lowest interest rates on home loans. However, it is crucial to consider other factors like processing fees, prepayment charges, and repayment options before making a final decision. It is advisable to do thorough research and consult with a financial advisor to make an informed decision and choose the best home loan option for your needs.